Howdy, my name is Seth. I’m an accountant, business owner, and father. Not long ago, I was in an interesting situation with debt and personal finances. This is my story of how I utilized the BuJo to get out of debt and onto the path of financial independence.

Along this journey you’ll learn my perspective on debt, finances, simple living, and how the BuJo ties into all of this. Bear with me as I take you through my story. I promise the BuJo comes in, full swing, after the necessary details.

My goal at the end of this is for you to understand how to set financial goals, track your spending daily and/or monthly, and track your net worth – all through the simplicity of the BuJo.

The final disclaimer I have is that my BuJo is not fancy. While I admire amazing spreads, I myself am utilitarian in my efforts. As a busy person, I do what works for me, period.

How I Got Into My Financial Mishaps

Wake up, go to work, look forward to the weekend plans, rinse and repeat.

This was my schedule after I graduated college. In short, I was living a pretty common life. A life that went with the flow and did what I was “supposed” to do.

Looking back, I would reframe this and call it an “unconscious” life. Even though I studied accounting, I found myself succumbing to the pressures of the real world in my early 20s. From 21 to 24, this was my reality. Despite being a frugal person my entire life, suddenly having a large sum of disposable income left over after bills each month was a foreign concept. One that I did not yet have any control over.

One where I would mindlessly spend, finance non-necessary items on credit cards, and upgrade items because “I deserve this” or I needed to maintain my expensive lifestyle habits.

Shortly after my 24th birthday, my son was born, I got a new job, and I purchased a home. All of these sound amazing, and they are in their own right – right?

But from a financial perspective, each of those changed my financial landscape drastically. And when these types of things are not planned or well thought through, they negatively impact the bottom line quickly. I literally saved $0 during this time.

Since I was already living an excessive lifestyle, adding a kid into the mix was a nightmare on our finances. Diapers, formula, latest loud plastic toy – check. Thankfully the new career paid slightly better, but that was negated quickly by increasing our rent by over 50%.

I know exactly what you’re thinking… “Seth, you’re an accountant! How in the world could you be so bad with money!?”

Just as the doctor who smokes knows it is bad for them, I too knew my spending habits were out of control. But how could I stop? I was addicted to the conveniences of life and the path of least resistance.

The major shift in my life was when I began thinking about my son, his future, and my future in general. If I continued to do everything exactly the same, how would our lives turn out? And more importantly, is this the life we want to choose to live?

One day a friend of mine sent me an article by Mr Money Mustache called, Your Debt is an Emergency! I told him I liked it a lot, so he sent me a few more, one of which was Dave Ramsey, specifically talking about his Snowball Method. Within less than a month I had consumed every piece of material I could get my hands on from these two.

Something clicked. My perspective wasn’t completely shifted yet, but it was beginning to tilt.

I began to see my faults and where I could begin making improvements. After acquiring all of that knowledge, I could no longer blame external factors, and came to the conclusion that I was going to do something about my situation, no matter what – for me and my son. For roughly the next two years I was relentlessly focused on one thing: being debt free.

Unfortunately for me, I was sitting on top of $240,000 of debt!

Getting Out Of Debt With My Bullet Journal

I quickly became obsessed with daily task lists. These kept me from deviating into spending spirals and kept me on track and consistent with my financial decisions. My girlfriend took note (or got tired of) all my Post-It notes around the house and random spiral notebooks everywhere. Luckily for me, not long ago she decided to try a method called the Bullet Journal method, that we all know and love.

She pestered me to try it. She kept saying how it would change my life and fit into my philosophy on living. Finally, I gave in and bought an official Bullet Journal. I figured if I spent the money on it, I would actually use it, since I had changed my perspective towards buying things.

I quickly immersed myself into the philosophy that Ryder writes about. I adopted the original format and that quickly evolved for me into my own system. Up until now I was literally writing down on a Post-It note how much I got paid, and then I’d subtract out my expenses through the next two weeks. It didn’t take long for me to realize the BuJo was the perfect place for a few financial spreads and trackers.

I made a commitment on July 1, 2015 to make conscious decisions and live with intent. This was when I began my journey to pay off my debt, and in just under two years I did it. Here’s a few of the methods I’ve utilized to help me along the way.

Income vs Expenses

Before we do anything else, we need a basic income vs expense calculation to see where we’re at financially.

Luckily, this is very simple. You can see below I simple wrote what my income was for each paycheck, and between those, I wrote out the expenses as they came due throughout the month.

You can choose to chunk it all into 1 month if you’d like to keep it even more simple. For me it was necessary because I had a lot of expenses coming due at the first of the month, so I wanted to ensure I had enough to cover that.

Here you can see the simplicity. Date, Item, +, -, Total. That’s it!

Now, what are we going to do with this information? We’re going to scrutinize it and really access where we can do better.

In the photo above, it’s a paycheck, food and groceries, gas, and some random purchases here and there. The “15th Bills” would be basically all my bills outside of my rent and internet service. Since this photo, it’s down even more to a whopping $242.

Some things I’ve cut out over the past two years are things like cable TV, martial arts classes, gym memberships (invested in a home gym), chiropractor, and other online services such as Netflix. The two biggest things for me were quitting smoking and cutting back to almost never drinking.

Another thing I did was negotiate or find cheaper options for things such as cell phone, car insurance, electricity and gas, and food.

Once you’ve identified some areas to cut back on, begin by taking action! Call the cable company to cancel your TV service, or whatever it is you need to do to get rid of that monthly payment. Maybe you need to refinance a student loan, so you can apply online within minutes.

The key here is to take some action towards the reduction of expenses.

And if you’re lucky enough to have some extra cash at the end of the month you have two options: Save it to build a small emergency fund or put it towards your debt.

There is debate on if you should put it towards the highest balance or the highest interest rate. I tended to pay off the highest interest rates first. Do whatever will give you the best psychological win.

Action items:

- List all your income and expenses

- Try to identify areas where you can cut back

- Divert extra cash to selected debts or savings goals

- Setting Goals

- Now that we understand our present situation a little better, let’s take a look at the future.

It’s impossible to hit the mark when there’s no target in sight. When you set goals, you naturally set yourself up for success. But the real key is breaking your goals down.

First, begin with the end in mind. Maybe your goal is to save a certain amount of money or pay off debts. Regardless, the scenario below (paying off debts) will show the process that will work in either situation.

My original goal as I stated was to be debt free. How could I accomplish that? Either make more money or spend less. I had just switched jobs at the time, so I decided to focus on spending less (as we went over above).

In December of 2015, I finally sold my house for a loss, because it was better than holding on to it any longer. So this put me right around $40,000 left to pay off.

I decided to break down each debt, as you can see below, there were quite a few. Each with varying balances and interest rates.

While there’s many ways you can do this, I simply just listed them out in no particular order and left some room to take notes below.

Simplicity is key here. You just need to know what you’re up against.

When I speak of daily goals, these are usually things like, “don’t buy a $5 latte and instead prepare your own coffee from home”. This is something I’d consider a habit breaker.

Monthly goals are easy because most things come with monthly payments. So to break down your overall goal, take a deep look at the total balance divided by the monthly payment to get the remaining months left.

Now you have a full picture of how long this is going to take with just the minimum payments. This is a good time to look at what you can put extra cash towards first.

Don’t be alarmed if some things calculate out to multiple years. You’ll throw extra cash at these eventually. And once a debt is paid off, we’ll roll that payment into other debts (snowballing it).

If your goal is to save more, then apply the same principles. Take the total you want to save and divide it by how much you can save a month to get how long until you meet your goal. Then see where you can cut back and divert more money towards your goal so you meet that goal quicker.

Don’t be overwhelmed! Now that you’ve got a vision of your financial timeline and goals, we can start digging into the details of tracking this stuff!

Another quick chart I did when I first began was to create a timeline for the absolute maximum amount of time it would take me to pay off the $40,000. Seeing that I wouldn’t pay off my last debt until 2023 made me have a whole new sense of urgency!

Action items:

- Set a long-term financial goal

- Begin to break that down into monthly and/or daily goals

- Daily and Monthly Tracking

How do we go about tracking this kind of stuff?

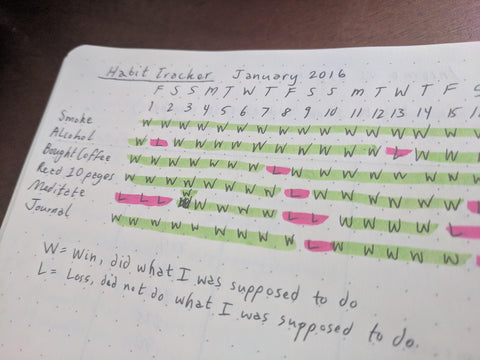

Here’s a fun way I found to track daily habits I wanted to break. This helped me to not spend so much money per day, which seriously adds up!

You can also use this type of daily tracker for motivation and rewards! So, if you can successfully go 6 days without a latte, then you reward yourself with one on the 7th – or something along those lines. Looking back the W and Ls weren’t that great of a system. I should’ve used a green vs red mark to be more visual and clear.

Most of my tracking however is on a month to month basis. The above graph is about as complicated as I get. My monthly stuff is pretty boring in comparison.

All I do is dedicate a single page in my BuJo to this. I write when I get paid, and then every single time I purchase something I pull out the BuJo shortly after and record it. It’s really similar to the above page that shows income vs expense. Except it has everything that I actually bought, not just my income and bills.

You’ll probably realize how much you actually spend on a daily basis. This is a great opportunity to see how many “No Spend” days you can do! Feel free to set up a graph like the one I showed above for this type of goal.

Again, this is super simple, but highly effective. At the end of the month, before I flip to another page and begin recording that month’s income, I take the remaining cash and either pay down debts or save it.

Net Worth Chart

Now that you’ve been tracking your spending on a monthly basis, something fun to do every now and then is check in on your net worth.

One of the coolest things to see if your NW going from the red and into the black.

When first starting decide if you want to track quarterly or monthly. I default to quarterly. At the end of each quarter, I can quickly scan my assets and my liabilities and see where I’m at.

I’m Out of Debt – Now What?

A quick thought here. Eventually you’ll be out of debt and you’ll want to know how much money to save up or what to do next.

I’m here to tell you about this magic concept called financial independence. Sometimes referred to online as “FIRE” for “Financial Independence Early Retirement”. The “RE” part is cool if you don’t like your job, but I’m just going to tell you about the “FI” part – the rest is up to you. FI = mandatory. RE = optional.

In my opinion, financial independence is all about freedom. Freedom from money and freedom of choice. For me, it’s about being able to make decisions in my life based off of the value I can provide to someone and not how much money am I going to get for this?

In short, to calculate how much money you’d need to be FI, take your total yearly expenses and multiply that by 25. Don’t forget to include expenses like healthcare, groceries, gas, etc.

Again, we go back to setting goals and breaking them down. If my FI number is $1M then I can begin to break that down and see how long it’ll take me to hit that number.

Sometimes this will lead to thinking outside the box.I wanted to find ways to become FI faster, so I did something I never thought I’d do: I started a business called Just Stop Spending, where I write about my journey and personal philosophy of financial independence..

Lastly, you’ll want to invest all this extra cash instead of just keeping it in a bank account. But how to invest all this extra cash is beyond this article. As I mentioned earlier, Mr Money Mustache for reading plus BuJo for tracking is a winning combination to get started with!

Parting Thoughts

I hope the above advice was sufficient in getting you started on your journey to financial independence. It’s been a rewarding path so far! After nearly two years of this, on May 15, 2017 I paid off my last debt. That was a great feeling submitting that last payment!

Without the intent and organization of the BuJo, I think it would’ve taken a lot longer. Living with intent is the real key here, just as Ryder talks about. Without those principles and concepts I would probably still be in debt and struggling a lot.

Once you’re living with intent and you have more of a purpose, little things like the spending and habit trackers do wonders for increasing your output and happiness. At the end of the isn’t that what this is all about? Living a more fulfilled, happy, and enjoyable life.

Personal finance in and of itself can lead to a lot of fulfillment and happiness. When you get into the habit of tracking your spending and living more intentionally, you’ll begin to realize how much more abundance you have without actually spending an extra dollar at the end of the day. That’s liberating! Seeing your net worth or a savings goal increase and reaping the long-term rewards of that is also very enjoyable.

Thank you Ryder and thank you all for reading. I wish everyone the best in their financial journey, and no matter where you are in life, remember to live the life you choose to live.

__

About the Author:

Seth Collins

Seth writes over at Just Stop Spending and is passionate about educating people about the wonderful life of FI and helping others to continually improve. When not chasing his son around at parks or taking naps with his cat, you can find him exploring in nature, creating something with his hands, or simply reading a good book with a cup of coffee. He's on the path to financial independence and strives to live a simple yet fulfilling life.

To find out more about Seth's endeavors check out:

https://juststopspending.com

Sofi yogev

April 04, 2024

Thank you so much, I need this information and I am starting now on this journey, once I’m feeling more aware I will want to check on Seth.