Get a handle on your finances

This month’s theme is finances. To give you a bit of inspiration on how you can manage your finances with your Bullet Journal, we put together this round up of ideas from Bullet Journalists around the world! Enjoy.

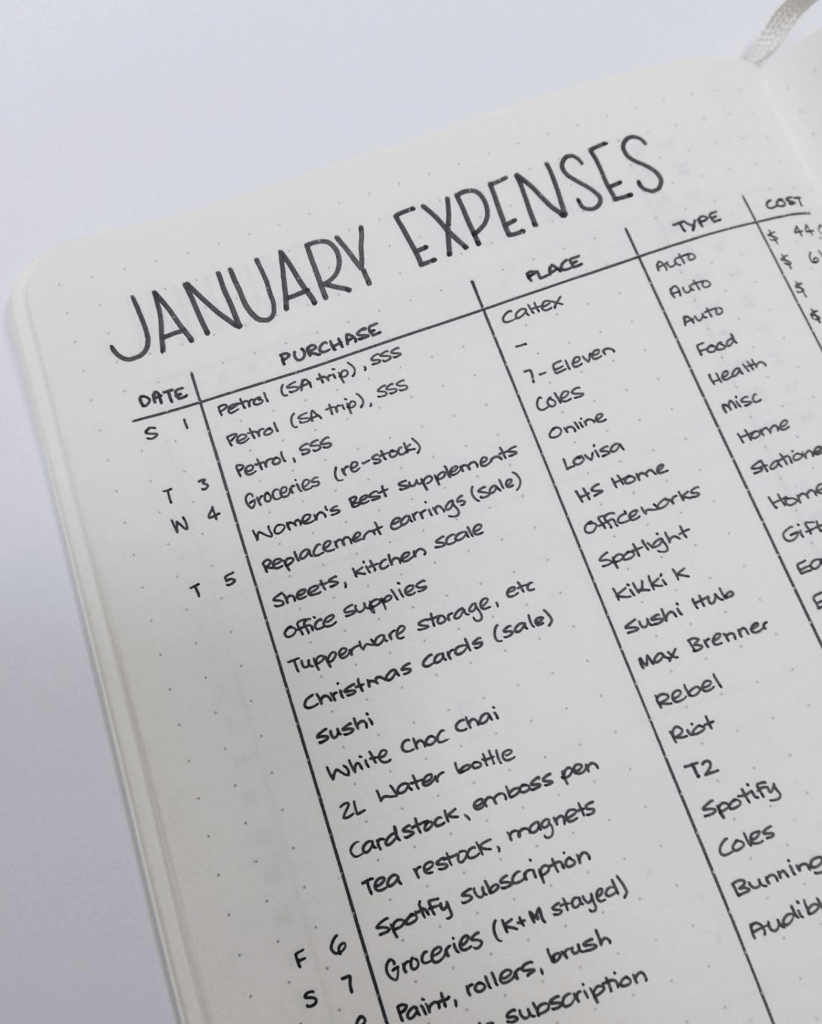

Expenses

A simple way to get started with tracking your finances in your Bullet Journal is by creating an expense tracker such as this one from Sara @thatbujokid. Create columns based on what you want to keep an eye on.

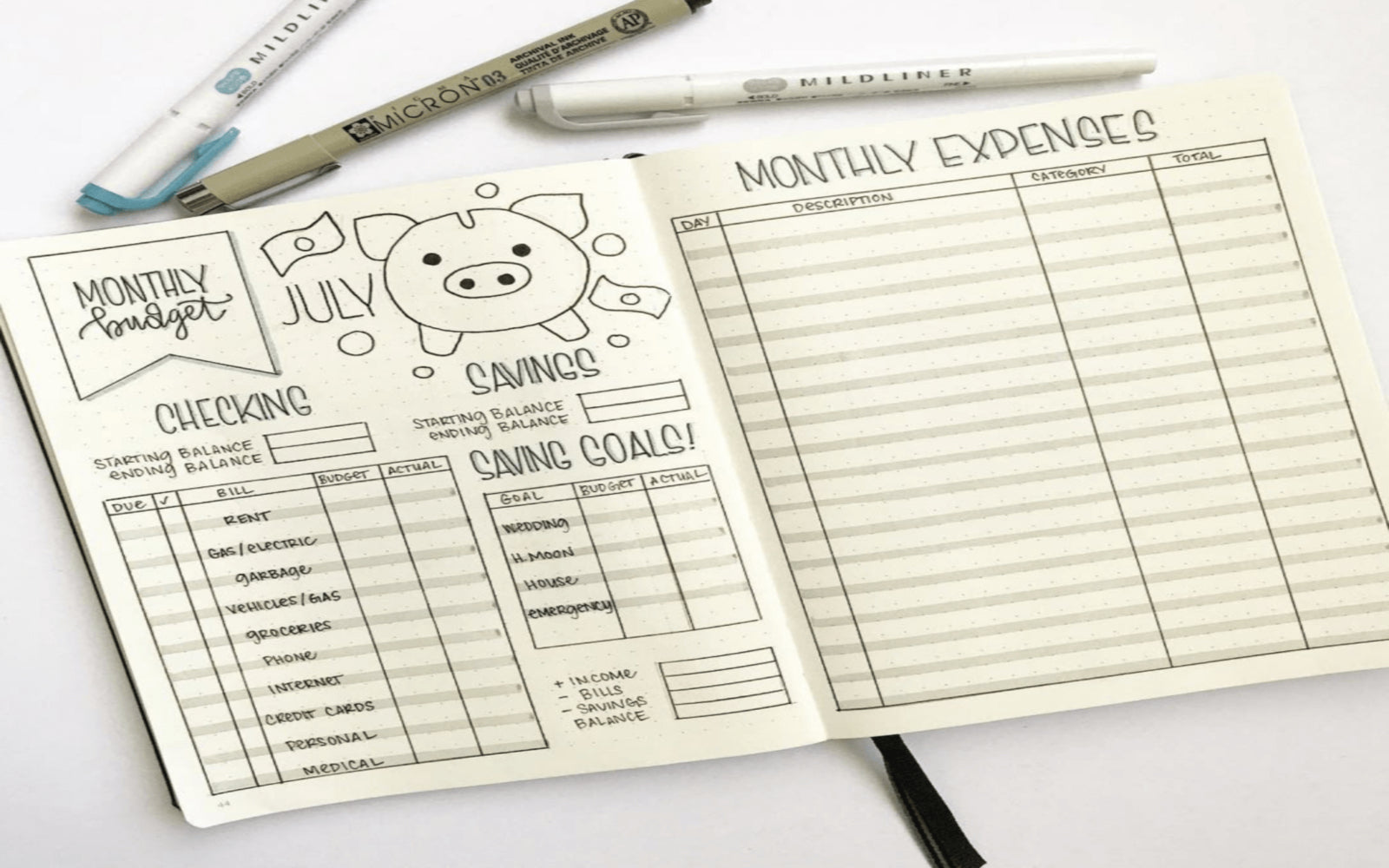

Budget & Expenses

Laurie @cardigansandchamomile set up a spread to keep track of her budget on the left and expenses on the right as a way to see everything easily at a glance.

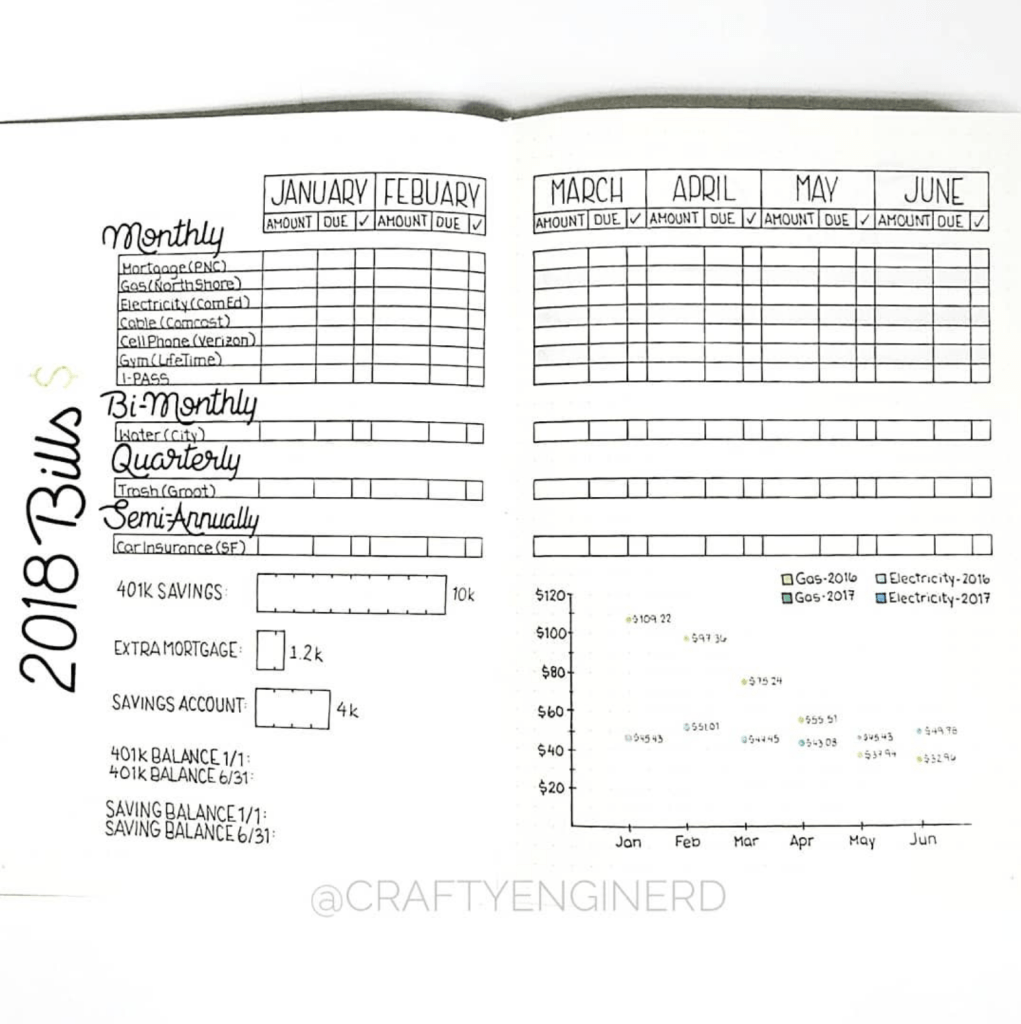

Bill Tracker

Hayden @craftyenginerd set up a spread where you can see the bills you have coming up monthly, bi-monthly, quarterly, and semi-annually as well as savings goals and even a little chart to see certain expenses and how they vary over time.

Subscriptions Tracker

Besides regular bills, we can sometimes forget to include subscriptions into our monthly budget. @Lazy.bujo shares a simple way to keep track of subscriptions similar to the bill tracker from before.

Savings

I couldn’t find the source for this image, unfortunately (please let me know if you know who this belongs to so I credit properly), but I loved this and had to share. This is a great way to keep track of bigger expenses so you can see the progress you’ve made over time and how much closer you are to saving up for, say, a house.

Debt

If you’re paying off debt, a great way to see progress over time is with a chart. Here, Erin @the.petite.planner, shares her credit card payoff debt tracker with the progress she’s made in chart and table form.

Hopefully this gave you some ideas on how you can get started tracking finances in your Bullet Journal. Other ideas for managing finances could be planning a travel budget and gift ideas. In addition, you could color-code categories or more information that you may want to keep an eye on.

Do you keep track of your finances in your Bullet Journal? If so, how? Feel free to share in the comments below.

Erica

January 15, 2024

I love all the help I can get with making budgeting and paying bills fun. Thank you